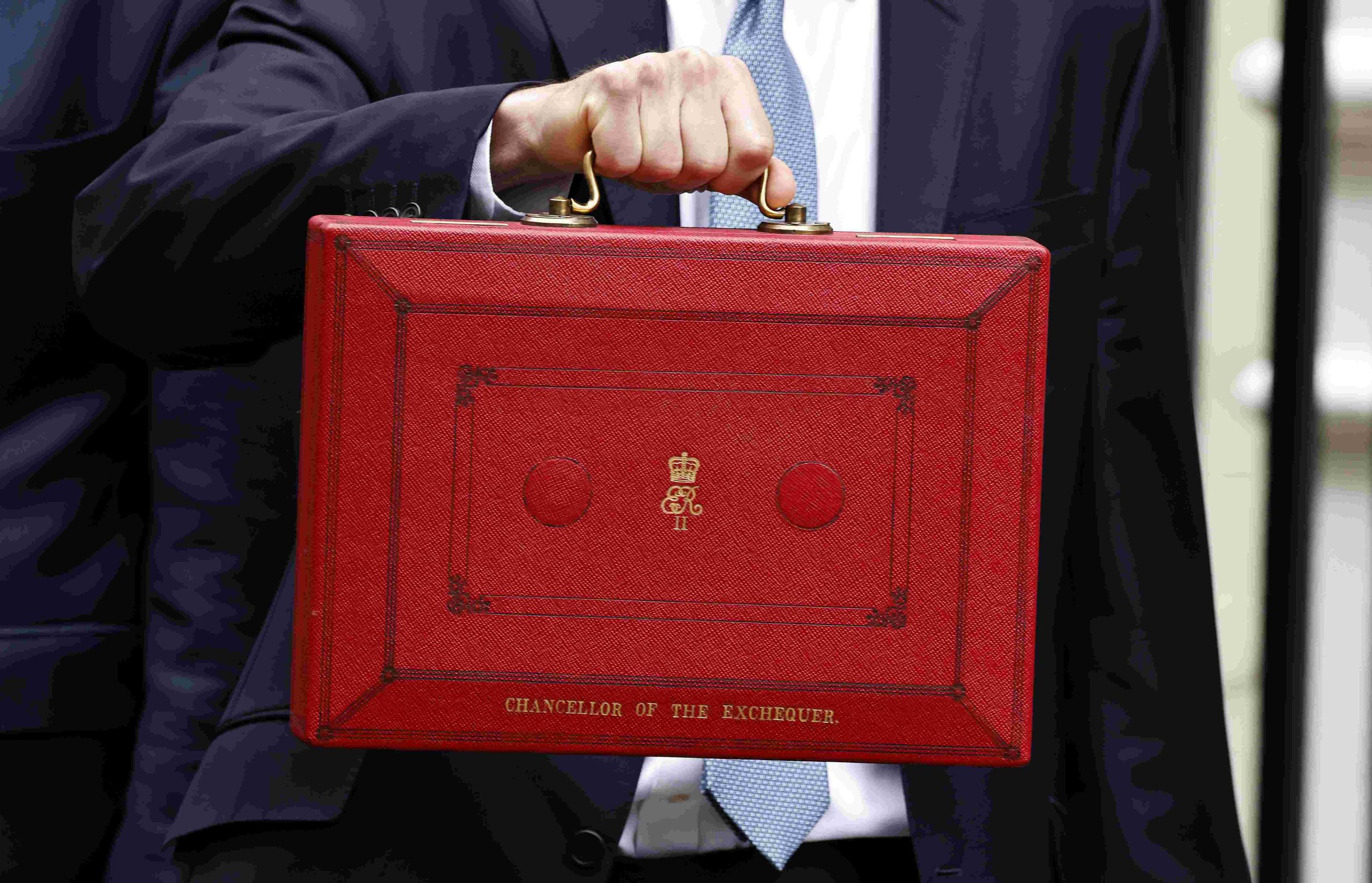

Spring Budget - Pensions

Everyone was taken by surprise with the announcements relating to pensions contained in the Spring Budget. Although it had been widely anticipated that the Lifetime Allowance would be raised, no-one predicted it would be scrapped entirely. This change, along with the increase in the Annual Allowance from £40,000 to £60,000 from April 2023, makes the changes in the Budget probably the most significant (certainly in terms of pensions) since Pension Freedoms were introduced in 2015.

To recap the main headlines:

The Annual Allowance (AA), which is the amount someone can pay into a pension each tax year, will increase from £40.000 to £60,000 from April 2023.

The Tapered Annual Allowance (TAA) minimum (the amount to which your Annual Allowance can decrease depending on your earnings) to go up from £4,000 to £10,000 from April 2023.

The Adjusted Income Threshold at which the TAA takes effect increases from £240,000 to £260,000 from April 2023.

The removal of the Lifetime Allowance (LTA) Charge from April 2023, followed by the abolition of the LTA completely from April 2024. This will provide significant scope for pension contributions to those people currently close to or over the LTA, including those who have taken out Individual or Fixed Protection in the past. Pension contributions can be ‘carried forward’ from the previous 3 tax years, meaning someone who has the earnings to justify the contributions could potentially pay a pension contribution of up to £180,000 in 2023/24.

Alongside this, a cap on the amount of tax-free cash someone can take of £268,275, which is 25% of the current LTA of £1,073,100. (See Ink’s Billy Johnson commenting on this change to Corporate Adviser here: https://corporate-adviser.com/budget-tax-free-cash-sting-in-tail-for-lta-break/

Increase in the Money Purchase Annual Allowance (MPAA) from £4,000 to £10,000. This will help those people who have accessed their pension but continued to work and want to make higher contributions.

The government is to work with employers and pension providers to encourage signposting to the midlife MOT and related support for employees.

All of the details are contained within the Spring Finance Bill 2023, which was published on 23rd March. If you’d like to speak to us about how these changes could affect you and your employees, please don’t hesitate to contact your Account Director.